Since 2013 Sebi has given an option for the MF investors to choose a Direct plan vs a Regular plan.

As a prima facia, if you are an aware & informed customer having time, knowledge, skills then you can invest in a Direct plan of mutual funds without the help of an advisor. However, you need to manage your own and no services would be given by any MF distributors. For any transactions like purchase, redemption, or switch, you have to approach to respective AMC directly. You won't get any kind of MF software to monitor your portfolio performance. Remember, after a certain period, each asset class & portfolio need to be rebalanced as per your risk appetite and asset allocation, in which more than 90% of investors fail to do so.

On the other hand, a Regular plan provides support from the person who is an MF expert. You get all kinds of investment services, software, rebalancing of portfolio, etc free of charge. You might be requiring the need for handholding when the market gets into deep correction or euphoria mode.

Therefore, choose your option carefully after studying the pros & cons of these two options.

- Can invest without MF distributors or intermediatory

- Expenses ratio are lower compared to Regular plan

- Get higher return compared to Regular plan

- Prefer if you can keep your emotions out - greed, fear, biases, human behavior, etc.

- Go for it if you are an expert in MF and can do your own investment analysis

- Can avail paid services of fee base RIA, if required

- Required in-depth research, time & skillset to pick MF scheme

- Need advisor in case of the market turmoil & volatility to guide you properly

- Not suitable for conservation, senior citizen or first-time investor

- Investment advice not available free, you have to pay for that

- Portfolio tracking & market awareness - self

- Paper documents & KYC - to do your own

- Although expenses ratio are lower compared to Regular plan your one mistake can prove much costlier than saving on the expense front

- Can invest through MF distributors or intermediatory

- Get support from MF distributors for their entire financial & allied services

- Get free software to access & transact your own

- You need to have a financial expert to support, assist & handhold, whenever required

- Investment advice available free

- Expenses ratio are higher compared to Direct plan

- Get lower return compared to Direct plan

- Choose your MF distributor carefully. Wrong MF distributor or incompetent distributor would not solve the purpose

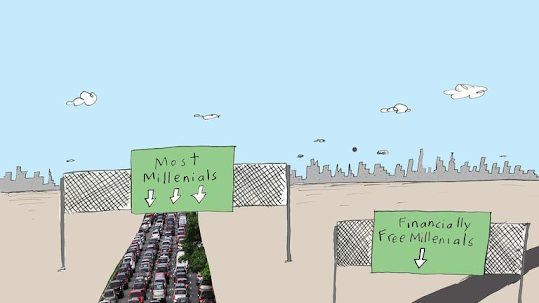

Although it is projected that you get a higher NAV, higher returns & lower expenses ratio under the Direct plan through which you can save a lacs of rupee in the longer term, the fact is that no one can become wealthy just by saving on the brokerage or fee side. Your one wrong decision without an advisor can put you years behind.

Remember, Mutual Fund Sahi Hai, but Advisor Jaruri Hai.